Tales from the Crypto: How to Think About Bitcoin

“Everything you don’t understand about money combined with everything you don’t understand about computers.”—HBO’s Last Week Tonight with John Oliver - March 11, 2018

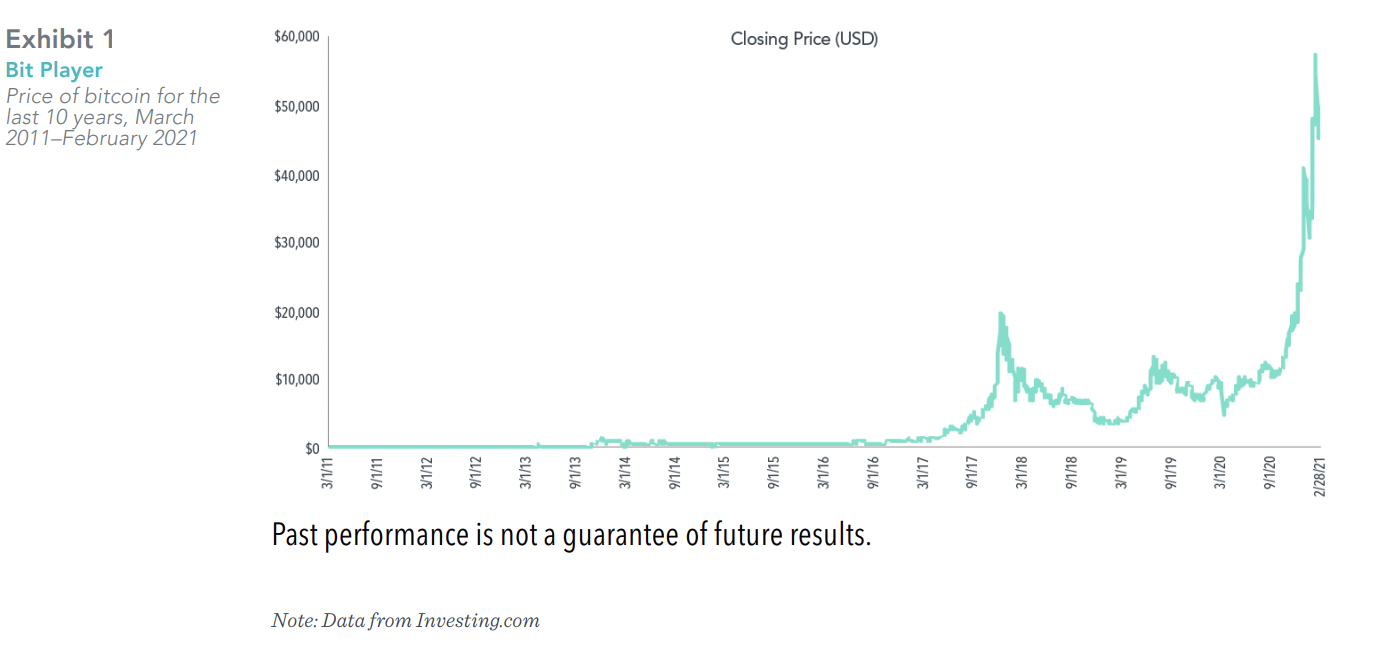

Bitcoin and related cryptocurrencies (now numbering in the thousands) are the subject of much debate and fascination. Given bitcoin’s dramatic price changes, it is not surprising that many are speculating about its possible role in a portfolio.

In its relatively short existence, bitcoin has proved extraordinarily volatile, sometimes gaining or losing more than 40% in price in a month or two. Any asset subject to such sharp swings may be catnip for traders but of limited value either as a reliable medium of exchange (to replace cash) or as a risk-reducing or inflation-hedging asset in a diversified portfolio (to replace bonds).

Assessing the merits of bitcoin as an investment can be problematic. Adding it to a portfolio could mean paring back the allocation to investments such as stocks, property, or fxed income. The owner of stocks or real estate generally expects to receive future income from dividends or rent, even though the size and timing of the payoff may be uncertain. A bondholder generally expects to receive interest payments as well as the return of principal. In contrast, holding bitcoin is similar to holding gold as an investment. Even if bitcoin or gold are held for decades, the owner may never receive more bitcoin or gold, and unlike stocks and bonds, it is not clear that bitcoin offers investors positive expected returns.

Putting aside squabbles over the future value of bitcoin or other cryptocurrencies, there are other issues investors should consider:

- Bitcoin is not backed by an issuing authority and exists only as computer code, generally kept in a so-called “digital wallet,” accessible through a password chosen by the user. Many of us have forgotten or misplaced computer passwords from time to time and have had to contact the sponsor to restore access. No such avenue is available to holders of bitcoin. After a limited number of password attempts, a user can permanently lose access. Since there is no central authority responsible for bitcoin, there is no recourse for the forgetful owner: a recent New York Times article profled the holder of more than $200 million worth of bitcoin that he can’t retrieve. His anguish is apparently not unusual—a prominent cryptocurrency consulting from estimates that 20% of all outstanding bitcoin represents stranded assets unavailable to their rightful owners.

- Mt. Gox, a Tokyo-based bitcoin exchange launched in 2010, was at one time the world’s largest bitcoin intermediary, handling over one million accounts in 239 countries and more than 90% of global bitcoin transactions in 2013. It suspended trading and fled for bankruptcy in February 2014, announcing that hundreds of thousands of bitcoins had been lost and likely stolen.

- The UK Financial Conduct Authority cited a number of concerns as it prohibited the sale of “cryptoasset” investment products to retail investors last year. Among them were the inherent nature of the underlying assets, which have no reliable basis for valuation; the presence of market abuse and financial crimes in cryptoasset trading; extreme price volatility; an inadequate understanding by retail consumers of cryptoassets; and the lack of a clear investment need for investment products referencing them.

The financial services industry has a long tradition of innovation, and cryptocurrency and the technology surrounding it may someday prove to be a historic breakthrough. For those who enjoy the thrill of speculation, trading bitcoin may hold appeal. But those in search of a sound investment should consider the concerns of the Financial Conduct Authority above before joining the excitement.

The opinions expressed are those of the author and are subject to change. The commentary above pertains to bitcoin cryptocurrency. Certain bitcoin offerings may be considered a security and may have different attributes than those described in this paper. Dimensional does not offer bitcoin.

This material is not to be construed as investment advice or a recommendation to buy or sell any security or currency. Investing involves risks including possible loss of principal. Stocks are subject to market fluctuation and other risks. Bonds are subject to increased risk of loss of principal during periods of rising interest rates and other risks. There is no assurance that any investment strategy will be successful. Diversification does not assure a profit or protect against loss.

The information in this document is provided in good faith without any warranty and is intended for the recipient’s background information only. It does not constitute investment advice, recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized copying, reproducing, duplicating, or transmitting of this document are strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

UNITED STATES: Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

CANADA: These materials have been prepared by Dimensional Fund Advisors Canada ULC. Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Unless otherwise noted, any indicated total rates of return reflect the historical annual compounded total returns, including changes in share or unit value and reinvestment of all dividends or other distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

AUSTRALIA and NEW ZEALAND: This material is issued by DFA Australia Limited (AFS License No. 238093, ABN 46 065 937 671). This material is provided for information only. No account has been taken of the objectives, financial situation or needs of any particular person. Accordingly, to the extent this material constitutes general financial product advice, investors should, before acting on the advice, consider the appropriateness of the advice, having regard to the investor’s objectives, financial situation and needs. Any opinions expressed in this material reflect our judgement at the date of publication and are subject to change.

WHERE ISSUED BY DIMENSIONAL IRELAND LIMITED OR DIMENSIONAL FUND ADVISORS LTD.

Neither Dimensional Ireland Limited (DIL) nor Dimensional Fund Advisors Ltd. (DFAL), as applicable (each an “Issuing Entity,” as the context requires), give financial advice. You are responsible for deciding whether an investment is suitable for your personal circumstances, and we recommend that a financial adviser helps you with that decision.

NOTICE TO INVESTORS IN SWITZERLAND: This is an advertising document.

WHERE ISSUED BY DIMENSIONAL IRELAND LIMITED

Issued by Dimensional Ireland Limited (DIL), with registered office 10 Earlsfort Terrace, Dublin 2, D02 T380, Ireland. DIL is regulated by the Central Bank of Ireland (Registration No. C185067). Information and opinions presented in this material have been obtained or derived from sources believed by DIL to be reliable, and DIL has reasonable grounds to believe that all factual information herein is true as at the date of this document.

DIL issues information and materials in English and may also issue information and materials in certain other languages. The recipient’s continued acceptance of information and materials from DIL will constitute the recipient’s consent to be provided with such information and materials, where relevant, in more than one language.

WHERE ISSUED BY DIMENSIONAL FUND ADVISORS LTD.

Issued by Dimensional Fund Advisors Ltd. (DFAL), 20 Triton Street, Regent’s Place, London, NW1 3BF. DFAL is authorised and regulated by the Financial Conduct Authority (FCA). Information and opinions presented in this material have been obtained or derived from sources believed by DFAL to be reliable, and DFAL has reasonable grounds to believe that all factual information herein is true as at the date of this document.

DFAL issues information and materials in English and may also issue information and materials in certain other languages. The recipient’s continued acceptance of information and materials from DFAL will constitute the recipient’s consent to be provided with such information and materials, where relevant, in more than one language.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

FOR PROFESSIONAL INVESTORS IN HONG KONG.

This material is deemed to be issued by Dimensional Hong Kong Limited (CE No. BJE760) (“Dimensional Hong Kong”), which is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

This material should only be provided to “professional investors” (as defined in the Securities and Futures Ordinance [Chapter 571 of the Laws of Hong Kong] and its subsidiary legislation) and is not for use with the public. This material is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence, or otherwise) the publication or availability of this material are prohibited or which would subject Dimensional Hong Kong (including its affiliates) or any of Dimensional Hong Kong’s products or services to any registration, licensing, or other such legal requirements within such jurisdiction or country. When provided to prospective investors, this material forms part of, and must be provided together with, applicable fund offering materials. This material must not be provided to prospective investors on a standalone basis. Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice.

Unauthorized copying, reproducing, duplicating, or transmitting of this material are prohibited. This material and the distribution of this material are not intended to constitute and do not constitute an offer or an invitation to offer to the Hong Kong public to acquire, dispose of, subscribe for, or underwrite any securities, structured products, or related financial products or instruments nor investment advice thereto. Any opinions and views expressed herein are subject to change. Neither Dimensional Hong Kong nor its affiliates shall be responsible or held responsible for any content prepared by financial advisors. Financial advisors in Hong Kong shall not actively market the services of Dimensional Hong Kong or its affiliates to the Hong Kong public.

SINGAPORE

This material is deemed to be issued by Dimensional Fund Advisors Pte. Ltd., which is regulated by the Monetary Authority of Singapore and holds a capital markets services license for fund management.

This advertisement has not been reviewed by the Monetary Authority of Singapore. This information should not be considered investment advice or an offer of any security for sale. All information is given in good faith without any warranty and is not intended to provide professional, investment, or any other type of advice or recommendation and does not take into account the particular investment objectives, financial situation, or needs of individual recipients. Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice. Dimensional Fund Advisors Pte. Ltd. does not accept any responsibility and cannot be held liable for any person’s use of or reliance on the information and opinions contained herein. Neither Dimensional Fund Advisors Pte. Ltd. nor its affiliates shall be responsible or held responsible for any content prepared by financial advisors

JAPAN

Provided for institutional investors only. This document is deemed to be issued by Dimensional Japan Ltd., which is regulated by the Financial Services Agency of Japan and is registered as a Financial Instruments Firm conducting Investment Management Business and Investment Advisory and Agency Business. This material is solely for informational purposes only and shall not constitute an offer to sell or the solicitation to buy securities or enter into investment advisory contracts. The material in this article and any content contained herein may not be reproduced, copied, modified, transferred, disclosed, or used in any way not expressly permitted by Dimensional Japan Ltd. in writing. All expressions of opinion are subject to change without notice.

Dimensional Japan Ltd.

Director of Kanto Local Finance Bureau (FIBO) No. 2683

Membership: Japan Investment Advisers Association

Excel Financial is registered as an investment advisor with the United States Securities and Exchange Commission (SEC), and only transacts business in those states in which it is properly notice filed or in which it qualifies for an exemption or exclusion from notice filing requirements. Nothing in this material should be construed as a solicitation or offer, or recommendation, to acquire or dispose of any investment or to engage in any other transaction.

All written content is for information purposes only. It is not intended to provide any tax or legal advice or provide the basis for any financial decisions. The information contained herein has been derived from sources believed to be reliable but is not guaranteed as to accuracy and completeness and does not purport to be a complete analysis of the materials discussed.